25+ Ky Vehicle Tax Calculator

On used vehicles the usage tax is 6 of the current average retail as listed. Web Home 2020 Vehicle Tax Information.

Obesity In Children And Young People A Crisis In Public Health Lobstein 2004 Obesity Reviews Wiley Online Library

Web If you have assessment questions regarding motor vehicles or boats please contact the Motor Vehicle Department at.

. 2019 Motor Vehicle Tax Rates. Web Daviess County Motor Vehicle Tax Rates. In order for the owner to be legal.

Web Usage Taxes and Fees. Web Usage Tax Fees. Web Free calculator to find the sales tax amountrate before tax price and after-tax price.

Web The Office of Property Valuation has compiled this listing to serve as a source of information for those affected by motor vehicle property taxation in the Commonwealth of Kentucky. Also check the sales tax rates in different states of the US. Use this handy sales tax calculator.

Web Motor Vehicle Property Tax. Feb 9 2022 Updated Feb 9 2022. 502 574-6450 or MotorVehiclejeffersonpvakygov.

Where can I find my. Historic motor vehicles are subject to state taxation only. The look-up for vehicle tax paid in 2020 is available at the bottom of the drivekygov homepage.

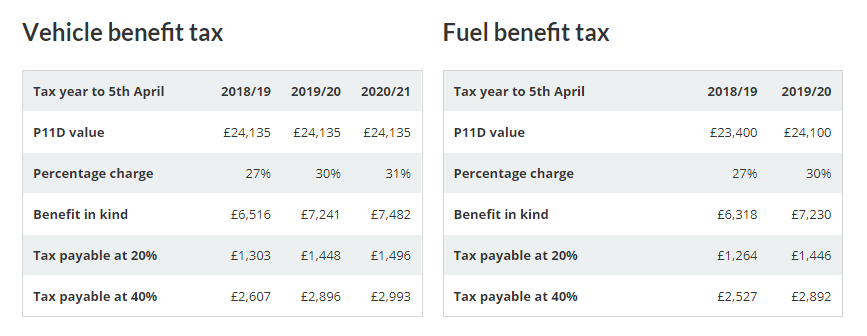

Web A 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. The Kentucky Department of Revenue administers two types of motor vehicle taxes. When you go to register your car in Kentucky your total tax bill will be.

2020 Motor Vehicle Tax Rates. Web Non-historic motor vehicles are subject to full state and local taxation in Kentucky. Web Kentucky VIN Lookup Vehicle Tax paid in 2022 Search tax data by vehicle identification number for the year 2022.

In the case of new vehicles. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. 2021 Motor Vehicle Tax Rates.

Web Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of Kentucky and shall be separate and distinct from all other taxes imposed by. Of course you can also. 2022 Motor Vehicle Tax Rates.

Web Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles. Web Missouri car sales tax rates are 4225 so you paid 97175 04225 X 23000 in Kentucky tax.

AP The Kentucky House voted Wednesday to give relief to taxpayers hit with hefty increases in their vehicle. Please enter a VIN. The state tax rate for non.

Web For consistency and uniformity the department has provided guidance to retailers and county clerks to shift taxation from sales and use tax to motor vehicle usage MVU tax. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. Please enter the VIN.

Motor Vehicle Property Tax Motor Vehicle Property Tax is. Web Motor Vehicle Taxes in Kentucky. Web If the assessment stays at 1300 the vehicle must be removed from Kentucky highways because its value is less than 25 of the retail value.

2480 Elrod Road Bowling Green Ky 42104 Mls Id Ra20235145 Crye Leike Executive Realty

Comcar Api Quick Start Guides

Pdf The Effects Of The Tax System On Education Decisions And Welfare

Rent An Suv As Low As 37 Or Save Up To 35 Off Base Rates Budget Car Rental

Corporate Intl Global Awards 2020 By Utopia Ventures Limited Issuu

Calculate Title Transfer Fees Linn County Ia Official Website

Car Tax By State Usa Manual Car Sales Tax Calculator

New Fuel Efficient Vehicles For Sale Lease In Mesquite Tx

Blue Ribbon Commission On Tax Reform Office Of The Lt Governor

Brhc10050751 Ex99 1slide25 Jpg

Kentucky S Car Tax How Fair Is It Whas11 Com

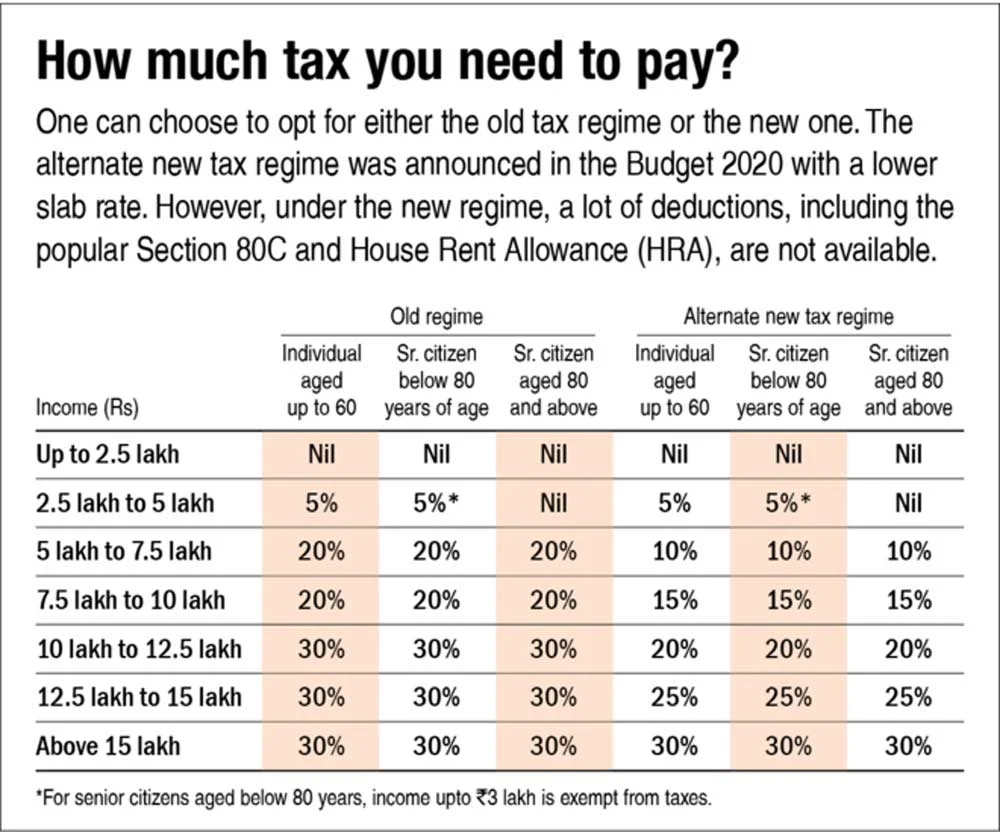

Tax Calculator Calculate Taxes For Fy 2023 24 Income Tax

Stock Market Today Live Updates

800 Eckler Rd Dry Ridge Ky 41035 Mls 618549 Rockethomes

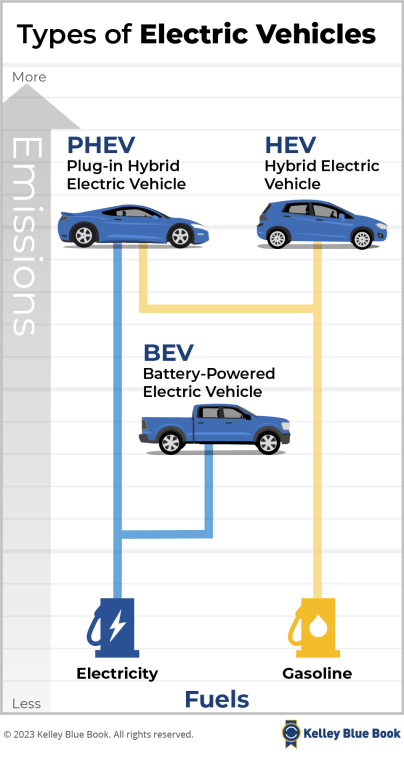

How Do Electric Car Tax Credits Work In 2024 Kelley Blue Book

T0q5nbsse8twkm

2022 Alice In Focus People With Disabilities Louisiana Released July 26 2022 By Louisiana Association Of United Way Issuu